Asim Riaz

On April 8, 2025, Saudi Aramco* signed a binding 20-year Sale and Purchase Agreement (SPA) with NextDecade Corporation to purchase 1.2 million tons per annum (MTPA) of LNG from Train 4 of the Rio Grande LNG project in Texas. This deal follows a non-binding agreement signed in June and is subject to a positive Final Investment Decision (FID) for Train 4. The LNG will be sold on a free-on-board (FOB) basis and priced against the U.S. Henry Hub benchmark, allowing Aramco full control over shipping and delivery.

2. Domestic Import Feasibility: Unlikely Scenario

Saudi Arabia holds around 263 trillion cubic feet (Tcf) of proven natural gas reserves (as of early 2025), placing it among the world’s top six producers. In 2023, the Kingdom produced roughly 4.2 Tcf of gas—equivalent to about 117 MTPA of LNG—used primarily for electricity, industry, and petrochemicals. Importing 1.2 MTPA of LNG would represent only 1% of Saudi Arabia’s current production and would require infrastructure that does not currently exist.

3. Strategic Purpose: Strengthening Aramco’s LNG Trading Portfolio.

Rather than meeting local demand, this deal signals *Aramco’s entry into the global LNG trading arena. While 1.2 MTPA is a small portion of the roughly 400 MTPA global LNG market, it marks a deliberate step in building a diversified energy portfolio. This follows Aramco’s recent strategic moves, including a $500 million investment in MidOcean Energy and discussions with Sempra on the *Port Arthur LNG project.

4. Destination Outlook: Asia and Europe, Not Saudi Arabia.

The LNG volumes under this agreement are almost certainly intended for export markets. *Asia* absorbed around 60% of global LNG imports in 2024, with China, India, and Japan among the top buyers. Europe remains a major growth area for non-Russian gas supply. Aramco can use its growing shipping and trading infrastructure to target high-demand periods—such as winter in Europe or summer in Asia—maximizing the commercial value of each cargo.

5. Implications for NextDecade and the Rio Grande LNG Project.

For NextDecade, this deal is a significant milestone. It brings a globally recognized buyer into the Train 4 development and helps secure long-term revenue, improving the project’s financial credibility. It also complements ADNOC’s existing 11.7% stake in Phase 1 of the project.

6. Conclusion: A Strategic Move, Not a Domestic Supply Plan.

This long-term *SPA* reflects Aramco’s strategic shift toward becoming a global LNG player. It is not about supplying Saudi Arabia with imported gas. Instead, the deal allows *Aramco* to diversify beyond oil, take advantage of competitive U.S. gas prices, and build a flexible LNG trading portfolio as global demand rises.

Sources:

– BP Statistical Review

– EIA

– Shell LNG Outlook 2024

– FERC filings

– Aramco Announcement (April 2025)

A competent and sincere leadership has the potential to capitalize significantly on the current opportunity presented by low crude oil and LNG prices.

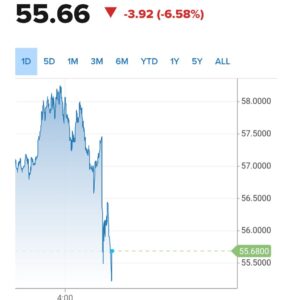

If Brent crude trends toward the $50/bbl mark, the new QP SPA on a DES basis will be priced at approximately $5.1/MMBtu—presenting a strong opportunity to supply RLNG to the industrial sector at around $6.5/MMBtu. This, however, is contingent on optimizing cost components across the RLNG value chain, including disproportionately high port charges, inaccurately calculated UFG losses, and the ongoing issue of the fertilizer sector’s cross-subsidy burden on industrial consumers.

Policy decisions under Musadik Malik have led to significant demand destruction within the industrial sector, especially among export-oriented industries. As a result, surplus RLNG volumes have accumulated, necessitating the deferment of two cargoes under the new QP SPA—part of a broader trend that has seen 17 cargoes either deferred or diverted. These deferments not only pose contractual and logistical challenges but also deprive the industrial sector of competitively priced RLNG that could have been secured amid low crude oil benchmarks.

Looking ahead, the global LNG market is expected to see a substantial supply influx, with new volumes from Qatar and the United States entering the market in 2025. This LNG wave is anticipated to exert downward pressure on global spot prices. Ironically, Pakistan’s planned procurement of the deferred cargoes is set to occur just as this oversupply materializes—missing the window to leverage this year’s favorable market conditions. The decision to defer cargoes in the current low-price environment reflects a strategic misstep.

Nonetheless, with competent and sincere leadership currently in place at the Petroleum Division and the Special Investment Facilitation Council (SIFC), there is a strong basis for optimism and a clear potential to capitalize on the opportunity presented by declining crude and LNG prices—provided that policy direction is realigned with sound economic rationale and the strategic priorities of the industrial sector .