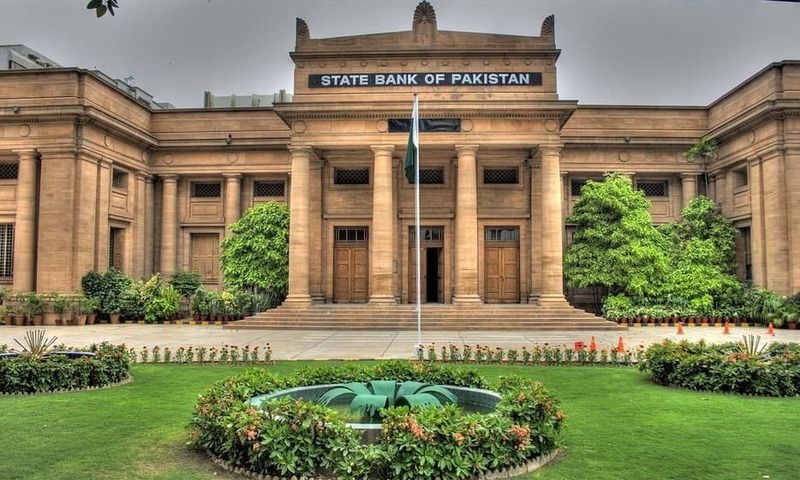

ISLAMABAD: The State Bank of Pakistan (SBP) released its Annual Report on the State of Pakistan’s Economy for fiscal year 2023-24, noting improvements in macroeconomic conditions driven by stabilization policies, successful IMF engagement, reduced uncertainty, and favorable global economic factors.

The report highlighted a moderate, agriculture-led recovery, with record wheat and rice harvests boosting agricultural output. The current account deficit narrowed to a 13-year low, supported by strong remittance growth and export performance, which outweighed a slight increase in imports. The Stand-By Agreement with the IMF helped enhance foreign exchange reserves and stabilize the foreign exchange market, contributing to a decline in the public debt-to-GDP ratio.

The SBP maintained a tight monetary policy, keeping the policy rate at 22% for most of FY24. Reforms in foreign exchange companies were introduced, while fiscal consolidation resulted in a primary balance surplus for the first time in 17 years. Inflation decreased from a peak of 38% in May 2023 to 12.6% by June 2024, averaging 23.4% for the year, down from 29.2% in FY23. This decline allowed the SBP to lower the policy rate to 20.5% in June 2024.

Despite these positive developments, structural challenges persist, including low investment, an unfavorable business climate, and energy sector inefficiencies. The report included a special chapter on reforming state-owned enterprises (SOEs), recommending measures based on international best practices.

Looking ahead, the report forecasts continued macroeconomic improvement in FY25, bolstered by the anticipated approval of the Extended Fund Facility (EFF) program with the IMF. A conducive global economic environment and ongoing fiscal consolidation efforts are expected to keep inflation pressures in check, with GDP growth projected between 2.5% and 3.5% for FY25.