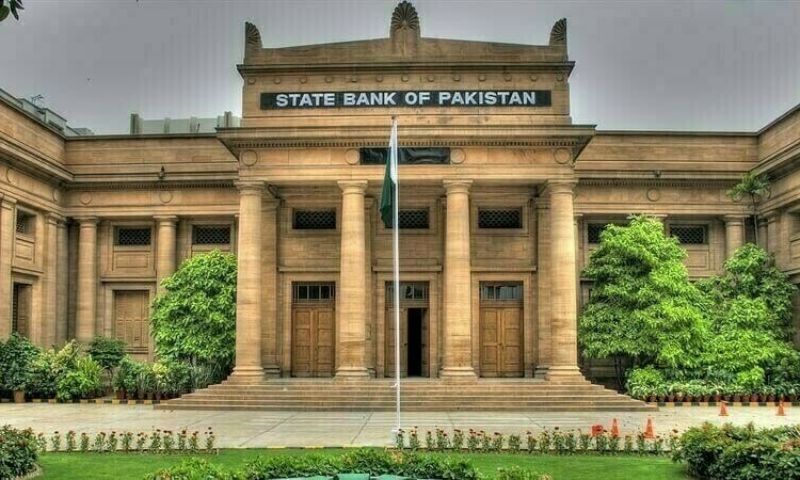

ISLAMABAD, October 18,2024: The State Bank of Pakistan (SBP) on Friday released its Governor’s Annual Report (GAR) for the fiscal year 2024, showcasing notable improvements in key macroeconomic indicators following two years of economic challenges.

The report, required under Section 39 (1) of the SBP Act, 1956, details the central bank’s monetary policy, the state of the economy, and the financial system. The report’s findings underline progress in inflation control, external account stability, and financial sector resilience.

The report highlighted a decrease in the National Consumer Price Index (NCPI) inflation in FY24, particularly in the second half of the year. This reduction was driven by the SBP’s tight monetary policy, fiscal consolidation, and softer global commodity prices.

External account pressures eased, contributing to a rise in foreign exchange reserves. The report credited reforms in the foreign exchange market, including those in exchange companies, with helping to stabilize the rupee.

The report noted a moderate recovery in GDP, driven largely by agriculture. Additionally, large-scale manufacturing showed signs of gradual improvement following a sharp contraction in the previous fiscal year.

While the inflation outlook began to improve in the first quarter of FY24, the SBP kept the policy rate unchanged at 22% for most of the year. This cautious stance was aimed at preventing inflationary pressures from taking hold.

The report also highlighted that Pakistan recorded its first primary surplus in 17 years, supported by a tight fiscal policy that helped reduce public debt relative to GDP.

Exchange rate stability was bolstered by the narrowing of Pakistan’s current account deficit, which fell to a 13-year low. A $3 billion Stand-By Arrangement (SBA) with the International Monetary Fund (IMF) and inflows from external creditors helped further stabilize the currency.

As inflation showed consistent signs of easing in the second half of FY24, the SBP reduced the policy rate by 150 basis points to 20.5% in June 2024, marking the first rate cut in over two and a half years.

The report emphasized the resilience of Pakistan’s financial sector, with banking sector deposits seeing notable growth due to elevated interest rates and the SBP’s push for financial inclusion and digital payments. Despite the tight monetary policy, loan delinquencies remained under control, and key financial indicators, such as capital adequacy and asset quality, showed improvement.

The report also highlighted the SBP’s efforts to promote financial inclusion. The National Financial Inclusion Strategy (2018-2023) was successfully implemented, and the development of its next version is underway, aimed at further expanding access to financial services and digital payments by 2028.

Overall, the GAR for FY24 paints a picture of a gradually improving economic landscape, supported by a cautious yet effective monetary policy, fiscal discipline, and financial sector stability.

You’ve laid this out in such a clear and logical way, love it!