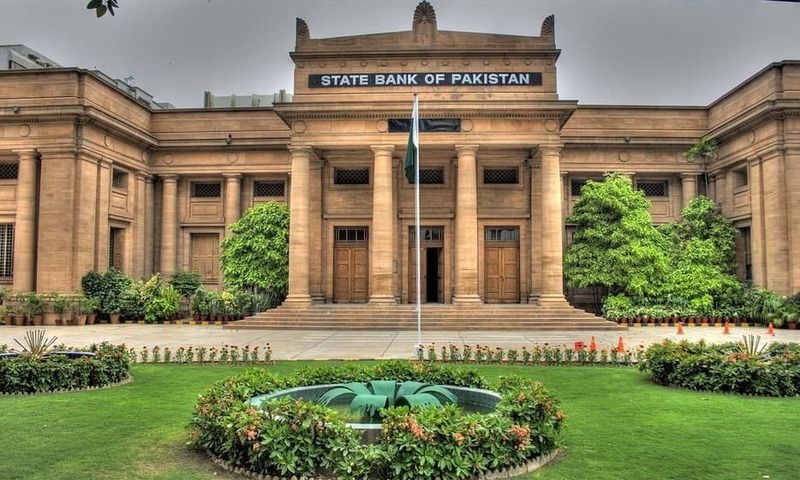

The State Bank of Pakistan (SBP) has said its Monetary Policy Committee (MPC) will meet on Monday, December 16, 2024 to decide about the Monetary Policy. Later on, SBP will issue the Monetary Policy Statement through a press release on the same day.

Pakistan has 15 % policy rate at present and traders representative bodies are calling upon the SBP to cut the policy rate substantially.

In the recent past , prime minister , Shahbaz Sharif, had hinted at cut in the policy rate.

Following the premier , Finance minister , Mohammad Aurangzeb , while chairing a meeting in Karachi last week had said he hopes SBP is going to make reduction in the policy rate.

The Federation of Chamber of Commerce and Industry (FPCCI) is pressing SBP to cut the policy rate by 450 basis points .

Pakistan has suffered huge in terms of finances due to unprecedented high policy rate. The policy rate as high as 22 % for around three years had crushed Pakistan’s economy . SBP remained totally a party to facilitate banking mafia by jacking up the policy rate at 22 % , which grabbed roughly Rs 1500 billion per annum for three years. SBP Governor , Mohammad Jamil, had been on the record saying the cut in policy rate saved Rs 1300 billion in a year. Is his this statement not an indictment against him?.

SBP might have continued to keep working as a facilitator to the banking mafia by keeping the policy rate at higher end , had SIFC not taken notice of this dirty business.

SIFC’s intervention forced SBP to start tapering the policy rate . Since SBP was granted autonomy by Imran rule in 2020 it used it as a cover to protect the banking mafia in the name of high inflation.

The policy rate as high as 22 % brought Pakistan’s business and industrial activities to a standstill . The industrialists and businessmen preferred to close down businesses and deposit their investment with the bank to get hefty profits.

At one stage , the banks were paying 20 % plus interest rate to the investors . SBP provided a golden opportunity to the banking mafia of Pakistan to make undue profit at the cost of Pakistan’s survival.